Running a pet shop is rewarding but comes with risks — from animal injuries to customer accidents and property damage.

That’s where pet shop insurance becomes essential. It protects your business, your animals, and your peace of mind.

In this detailed guide, you’ll learn everything about pet shop insurance — what it covers, why it’s important, how much it costs, and how to choose the right policy for your store.

🐾 What Is Pet Shop Insurance?

Pet shop insurance is a specialized business insurance policy designed to protect pet store owners from financial losses caused by accidents,

injuries, theft, or lawsuits. It combines several coverage types into one plan to ensure your entire operation — from animals to employees — stays protected.

It’s not just about property protection. If a dog bites a customer, or a customer slips on a wet floor, your business could face legal claims. Pet shop insurance ensures you’re covered against these unexpected situations.

🏪 Why Every Pet Shop Needs Insurance

Pet shops are unique — they deal with living creatures and customers simultaneously. That means multiple risks every day:

- Animal injuries or illness while under your care

- Customer liability for bites or scratches

- Employee accidents while handling animals

- Theft or damage to expensive stock like aquariums, cages, or exotic pets

- Fire or water damage to your shop premises

Without insurance, even one incident could cause massive financial loss. With a tailored pet shop insurance policy, you can protect against these risks and run your business confidently.

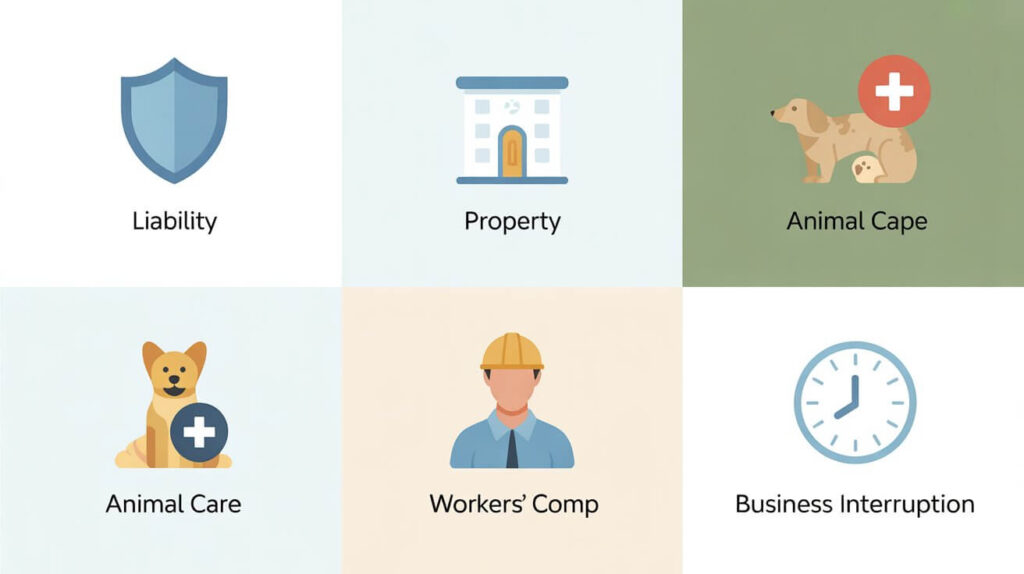

🔍 Types of Coverage in Pet Shop Insurance

A solid pet shop insurance policy usually includes a mix of different coverage types. Here’s a breakdown of the most essential ones:

1. General Liability Insurance

Covers injuries or property damage caused to customers or visitors.

Example: A customer slips on spilled water near an aquarium and breaks an arm. Liability insurance pays for medical costs and potential legal fees.

2. Animal Bailee Coverage

Protects you if a pet in your care is injured, lost, or dies accidentally.

Example: A boarding pet escapes or gets sick while under your supervision — this coverage compensates the owner.

3. Commercial Property Insurance

Covers damage to your building, cages, tanks, food stock, or pet supplies from fire, theft, or vandalism.

4. Business Interruption Insurance

If a disaster forces your shop to close temporarily, this covers lost income until you reopen.

5. Workers’ Compensation Insurance

Legally required in most U.S. states, it covers employee injuries or illnesses that occur on the job.

6. Professional Liability (Errors & Omissions)

If you offer services like pet grooming or advice, this protects against claims of negligence or professional mistakes.

7. Product Liability Insurance

If a product you sell harms an animal or customer, this covers damages or medical costs.

💡 Tip: Always review your policy carefully — not all insurers include every coverage by default.

💰 How Much Does Pet Shop Insurance Cost?

The cost of pet shop insurance depends on several factors:

- Location: Urban stores may pay more than rural ones.

- Business size: Larger shops with more staff or animals face higher risk.

- Services offered: Grooming, boarding, or exotic animal handling increases premiums.

- Claims history: A clean record helps lower your rates.

- Coverage limits: Higher protection means higher costs.

On average, small to mid-sized pet shops in the U.S. and U.K. can expect to pay:

| Coverage Type | Average Monthly Cost |

| General Liability | $30 – $60 |

| Property Insurance | $40 – $80 |

| Workers’ Compensation | $70 – $120 |

| Full Business Package | $120 – $250 |

👉 Pro Tip: Bundle your policies with one insurer to save up to 20% in discounts.

🧾 Real-Life Example: Why Coverage Matters

Imagine a scenario:

A puppy bites a child inside your store. The parents sue your business for medical bills and emotional distress, demanding $25,000.

Without pet shop liability insurance, you’d pay this amount out of pocket — potentially forcing your shop to close.

With proper coverage, your insurance company handles the claim, legal defense, and settlement — protecting both your finances and reputation.

🌟 Benefits of Having Pet Shop Insurance

Having pet shop insurance does more than protect your finances — it builds credibility and trust with your customers.

Here’s how it helps:

- Financial Protection: Avoid large out-of-pocket expenses from unexpected accidents.

- Customer Confidence: Clients feel safer leaving their pets with a licensed, insured shop.

- Legal Compliance: Many U.S. states and landlords require insurance proof.

- Peace of Mind: Focus on running your business without constant worry.

🧠 How to Choose the Best Pet Shop Insurance

Selecting the right insurer can be challenging. Follow these practical steps:

1. Assess Your Risks

List every possible risk — from animal care to customer safety. It’ll help you choose the right mix of coverage.

2. Compare Providers

Look for insurers specializing in pet-related businesses, such as:

3. Check Coverage Limits

Don’t settle for minimum coverage. Ensure your policy can handle worst-case scenarios.

4. Read the Exclusions

Some policies exclude exotic animals or grooming services. Always read the fine print.

5. Ask About Add-Ons

You can add extra coverage for grooming tools, delivery vans, or boarding facilities.

🧩 Common Mistakes Pet Shop Owners Make

Avoid these costly errors when purchasing pet shop insurance:

- Choosing the cheapest policy: Low cost often means limited protection.

- Ignoring business interruption coverage: It’s crucial during closures.

- Not updating your policy: As your shop grows, your risks change too.

- Skipping workers’ compensation: This can lead to legal penalties in the U.S.

🦴 Tips to Lower Your Pet Shop Insurance Premium

Here are smart ways to keep your insurance costs manageable:

- Install security systems — alarms, cameras, and sprinklers.

- Train employees on animal handling and safety protocols.

- Keep clean records of customer waivers and employee training.

- Bundle multiple coverages (liability, property, and workers’ comp).

- Shop around — get at least three quotes before choosing.

Even small safety measures can reduce your premiums significantly.

🌐 External Resources Worth Exploring

For trustworthy information on pet safety and health:

- ASPCA: American Society for the Prevention of Cruelty to Animals

- RSPCA: Royal Society for the Prevention of Cruelty to Animals

- PetMD: Expert Pet Health Advice

These resources can help you improve pet care standards and reduce insurance risks.

🏁 Final Thoughts: Protect Your Pet Business Before It’s Too Late

Running a pet shop means caring for both animals and customers — a big responsibility. Pet shop insurance ensures you’re covered against the unexpected, from property damage to liability claims.

Don’t wait for an accident to remind you of its importance. Protect your shop, your employees, and your furry guests today.

✅ Call to Action:

Start comparing pet shop insurance quotes now from trusted providers in your area — and secure the future of your business and the pets you love.

Pingback: ASPCA Pet Insurance Discounts Save More on Quality Pet Coverage ASPCA Pet Insurance Discounts Save More on Quality Pet Coverage

Pingback: 2026 Volvo XC90 A Luxurious and Safe SUV for the Modern Family 2026 Volvo XC90 A Luxurious and Safe SUV for the Modern Family